Anyone involved with trying to pass a bond proposal knows there are a lot of moving parts. After working with your community and board to develop a proposal and abiding with the technical requirements of placing the question on the ballot, you are faced with the daunting task of asking voters to commit their hard-earned dollars to support a plan that will cost the community millions. Messaging is critical. There are seemingly an unending number of variables to consider. Ultimately, you are faced with turning complex details into a simple and concise message and presenting this message to a wide variety of constituents in your community. When considering everything that is at stake, this can feel like a daunting task!

Anyone involved with trying to pass a bond proposal knows there are a lot of moving parts. After working with your community and board to develop a proposal and abiding with the technical requirements of placing the question on the ballot, you are faced with the daunting task of asking voters to commit their hard-earned dollars to support a plan that will cost the community millions. Messaging is critical. There are seemingly an unending number of variables to consider. Ultimately, you are faced with turning complex details into a simple and concise message and presenting this message to a wide variety of constituents in your community. When considering everything that is at stake, this can feel like a daunting task!

Obviously, there is much to consider, and there is no “one size fits all” approach when it comes to messaging. That said, this article is intended to share a simple and effective strategy that can be used as part of your marketing and informational campaign. This approach also has benefits that extend beyond Election Day and can help market your bonds to a larger number of investors, increasing community buy-in and potentially driving down interest rates. To put it simply, the idea is to offer a retail order period with your residents getting priority.

When considering constituents, school leaders hope their communities are “invested” in their district. Normally when we think of people invested in the district, we think of people like band and athletic boosters, volunteers, unpaid board members, etc. These individuals all certainly meet a definition of being invested in the district. They invest their time and often financial resources with the hopes of getting a return that is not necessarily defined financially (but which is still very real). When you sell bonds, however, you offer your community the opportunity to “invest” in your district in the strictest financial sense of the term. You give them the opportunity to receive a financial return for investing in the school district! This is accomplished by creating a retail bond order period that gives your community members first priority when it comes time to purchase the bonds. Doing this essentially makes sure your community members are first in line when the sale occurs.

Giving your community priority when it comes to the sale of your bonds has tremendous value. It has value as a marketing strategy during your informational bond campaign, and it has value after your bond vote in helping spread positive district news. Perhaps the best part is that it is simple to do. You simply have to make it known to your Municipal Advisor and your Underwriter that you would like your community to have priority when it comes to buying your bonds. Your Underwriter will then create a retail order period that will make sure orders from your community members are filled first (prior to orders from retail and institutional investors who live outside your community).

From a pre-vote informational perspective, adding a statement that your bonds will be made available on a priority basis to members of your community shows you are considering the impact your bonds will have on all of your constituents. The ballot question itself is asking your community to pay the interest on the bonds through a millage. Why not allow these same individuals the opportunity to benefit from this interest? Municipal bonds are attractive to certain types of investors – generally older, wealthy individuals who are looking for a source of federally tax-free revenue. These individuals may not have any other connection to your district, which means you are reaching a constituency that otherwise may not have an interest in your ballot question.

The benefits of this approach do not end after your election. If your referendum is successful, during the pre-sale process, you and your Underwriter will host a retail investor informational session for people who are interested in purchasing the bonds. During this meeting, your Underwriter will share details as to how your community members can go about obtaining the bonds. More importantly, this meeting will give you an opportunity to share details of the capital plan, while at the same time deepening connections with this constituency. Additionally, when the time comes to sell the bonds, retail orders can have a positive impact on marketability. A strong retail order period can be seen by institutional investors as an indication of strong demand. This demand can lead to a high level of institutional participation, which in turn can have the potential to drive down interest costs.

In conclusion, giving your community the opportunity to purchase bonds on a priority basis has many benefits and is easy to do. It is an approach that has been successfully implemented by several school districts and other municipalities and is worthy of consideration as you undertake the complicated task of preparing a bond proposal.

For more information regarding creating a retail order period with local priority, feel free to reach out to the author of this article, Raymond James Public Finance Director Paul Soma.

About the Author:

Paul Soma leads Raymond James’ Michigan municipal finance efforts. Mr. Soma joined Raymond James in 2019 after a 27-year career in public education where he served as business manager for three school systems, and most recently as superintendent of Traverse City Area Public Schools (TCAPS). He has a passion for public education and the students it serves. He has extensive knowledge of the issues educators deal with on a daily basis, including a deep understanding of Michigan school finance. As a chief business official and as a superintendent, Mr. Soma led a number of successful bond campaigns and oversaw the resulting bond sales associated with those campaigns. Having been a school business official and Superintendent, Mr. Soma knows the magnitude and complexity of the job of running a school system. This knowledge serves him well as he works with school leaders to bring their bonds to market. Mr. Soma began his professional career as a financial auditor at Deloitte. He holds an accounting degree from Michigan State University and a master’s in educational leadership from Grand Valley State University. Mr. Soma is a registered CPA and currently holds the Series 50, 52 and 63 licenses.

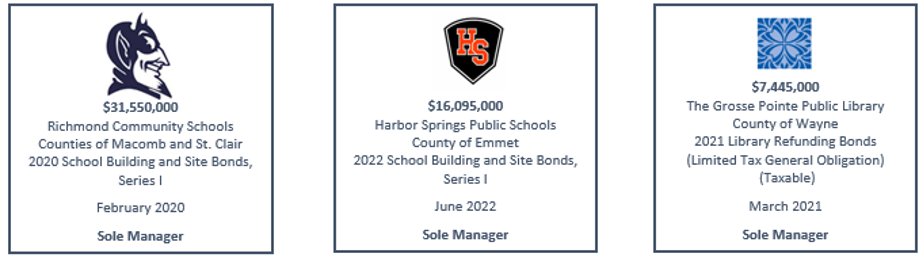

Recent Raymond James’ sole managed transactions with positive impact from a local retail order period: